Can I Upload My Filled Irs Tax Files

You may be eligible to modify your business'due south tax classification if you file IRS Form 8832. It'due south non for everyone – simply sure businesses qualify, but information technology tin be financially beneficial.

Find out if your business qualifies for a change in taxation classification in this guide.

THIS POST MAY Contain AFFILIATE LINKS. Delight READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I'll receive a small commission.

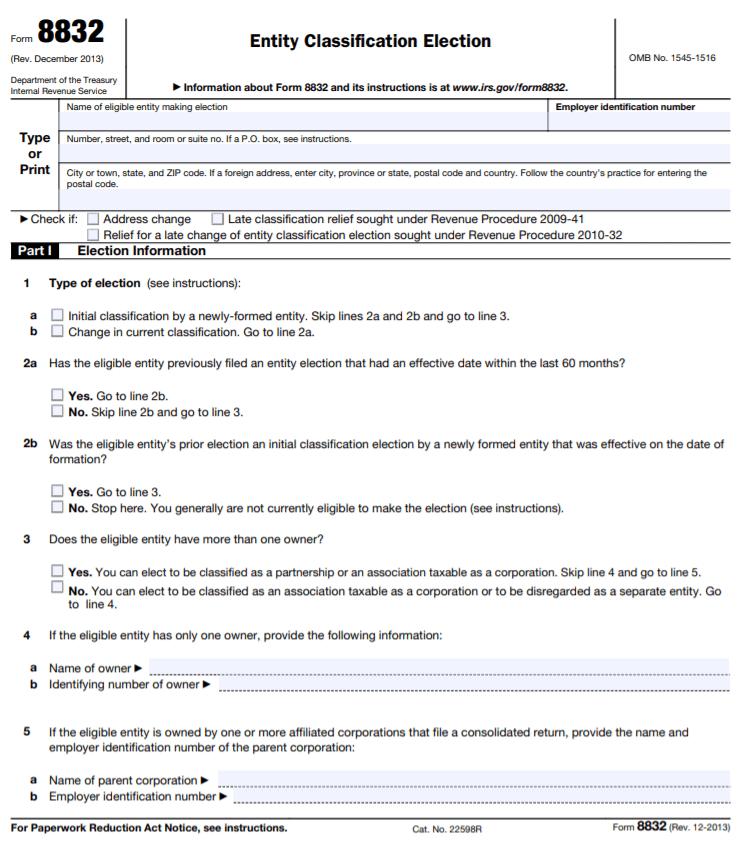

What is IRS Class 8832?

IRS Form 8832 is for LLC companies that wish to change their revenue enhancement filing status. Normally a one-member LLC is taxed as a sole proprietor, and a multi-member LLC is taxed equally a partnership.

LLC owners can change their filing status with IRS Form 8832, though. This course is strictly for tax purposes – it doesn't change your business's construction, but it may help y'all save money on your taxation liabilities.

Form 8832 is chosen the Entity Classification Election. As an LLC, the IRS assigns a default tax classification as we discussed higher up, merely this may get out you paying more taxes than you should.

Using Form 8832 allows you to be taxed as a C-corporation rather than a laissez passer-thru entity. In other words, the income and tax liabilities are divide from your private income and taxes.

Case Scenario for Form 8832

John started his own company last twelvemonth. It was a piddling visitor that sold digital products to consumers to brand their lives easier. John thought it would exist a 'hobby' business and he would make a trivial side greenbacks.

He wasn't worried about the income causing him crazy loftier tax liabilities. John filed as an LLC just to protect himself since he was selling products to consumers and didn't want the financial liability of any mishaps.

Fast forward six months and John'due south business is booming. His income is triple that of what he makes at his job, and his tax liabilities are heaven high.

John's tax auditor suggested that he file IRS Form 8832 to limit the income that 'passes through' to his private tax return, otherwise John'due south tax liability would be much higher than he anticipated.

He filed class 8832 and elected to take his single-member LLC classified as a C-corp for the tax year to limit his liabilities.

File with Ease from Domicile Today!

Frequently Asked Questions Yous Must Know

Now that we have the basic done, let'southward go through the top questions regarding this IRS form.

Where do you mail IRS Form 8832?

Where your business operates determines where you mail IRS Form 8832. Businesses in Connecticut, Wisconsin, Delaware, West Virginia, District of Columbia, Vermont, Illinois, South Carolina, Indiana, Rhode Island, Kentucky, Pennsylvania, Maine, Ohio, Maryland, North Carolina, Massachusetts, New York, Michigan, New Jersey, or New Hampshire send it to:

Send to: Department of the Treasury Internal Revenue Service Heart Kansas City, MO 64999

Businesses in Alabama, Wyoming, Alaska, Washington, Arizona, Utah, Arkansas, Texas, California, Tennessee, Colorado, South Dakota, Florida, Oregon, Georgia, Oklahoma, Hawaii, North Dakota, Idaho, New Mexico, Iowa, Nevada, Kansas, Nebraska, Louisiana, Montana, Minnesota, Missouri, and Mississippi send it to:

Send to: Department of the Treasury Internal Acquirement Service Center Ogden, UT 84201

Does a unmarried-fellow member LLC need to file form 8832?

If a single-fellow member LLC wants to modify his/her tax classification to a C-corp, then yeah, you must file form 8832. If yous want to keep your laissez passer-through entity as-is, at that place's no reason.

How long exercise I have to file form 8832?

You can file form 8832 at any time during your business's lifetime, only information technology's only effective upward to 75 days before your filing appointment or up to 12 months after the filing date and then time it accordingly.

Do I need to file form 8832 and 2553?

No, yous'll file 1 course or the other – not both. If y'all're an LLC and want to file taxes equally a C-corp, file IRS Course 8832, and if you're an LLC or corporation that wants to file as an S-corp, file Form 2553.

Data: 40% of Small Biz Owners Get Paid by Check

Who must file Form 8832?

No 1 is obligated to file Form 8832. Only those LLCs that want a different taxation classification for a given year must file it. If you're okay with your default tax classification, you lot tin file your taxes every bit normal.

Who must sign Class 8832?

Whatsoever electric current business owners or officers who are currently involved in the business should sign it. This gives the IRS a contact person should they have any questions. Notwithstanding, if yous're filing for a retroactive date (up to 75 days), whatever previous owners or officers at that time must also sign it.

How long does it take to complete IRS Form 8832?

Information technology shouldn't take much longer than 15 minutes to complete the class. It's straightforward and the IRS instructions arrive simple.

File with Ease from Habitation Today!

Peak 4 Tips to Make Your Process Easier

ane. Make sure y'all cull the correct type of election

- If you but started your business organisation and desire to change your tax classification, choose 'initial classification by a newly-formed entity.'

- If you already filed taxes under your current classification, cheque 'change in current classification.'

2. You may merely change your tax nomenclature once every five years unless you meet one of the post-obit exceptions:

- If your earlier ballot was for a newly formed entity

- If the business'south buying changed (at least 50% must modify) just this requires a individual letter of the alphabet ruling from the IRS

3. Choose your constructive date carefully, if you're choosing anything other than the first date of business, consult with a tax professional to decide the best engagement

4. You may exist eligible for belatedly election relief if yous:

- were previously denied form 8832 blessing because you missed the filing date

- had a likely cause for the late filing

- are no more than 3 years tardily

Lesser Line

Choosing your business's tax nomenclature affects your bottom line. Get professional person advice to make up one's mind which nomenclature is right for your business.

Don't assume you lot can simply change your filing status when and if it benefits you.

Without IRS Form 8832, the IRS puts you in a default classification. Yous need approval to modify your classification, but seek advice before doing so to make sure it will have the favorable taxation effect you lot want.

For more coin-saving tips and guides,subscribe to the weekly newsletter!

I promise this helps your situation.

If you enjoyed this article, so you'll love these:

- Best Rules for Claiming a Dependent on Your Taxation Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Render?

- How to Choose the Best Filing Condition

- Pinnacle 12 Things You Must Know Virtually the New Tax Police

Get started on your taxes early on here!

Until the side by side money take a chance, take care!

Handy

Disclaimer Statement:All data and data provided on this site is for advisory purposes but. The Handy Tax Guy makes no accented representation to the correctness, mistakes, omissions, delays, ceremoniousness, or legitimacy of whatever data on this site. **Note: Each client circumstance will vary on a example by case basis**

Source: https://handytaxguy.com/irs-form-8832/

0 Response to "Can I Upload My Filled Irs Tax Files"

Post a Comment